TraderAdda Nifty Options Open

Interest Tracker

Tracker Times:- 11 AM, 1 PM, and 3 PM

1.00 PM --- OI

Open Interest for Nifty Options :-

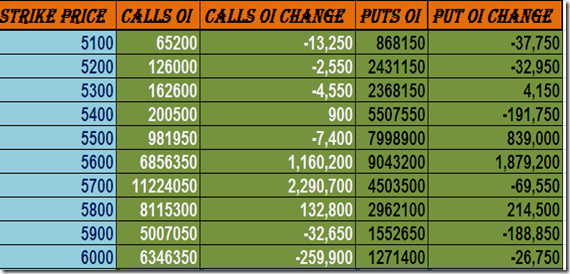

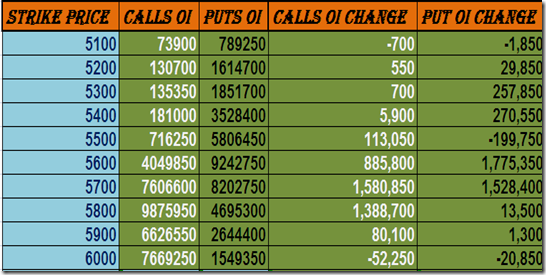

1. Open Interest Table:-

Showing Open Interest for Nifty Options for Different Strike Price with Change in OI for Respective Strike Price.

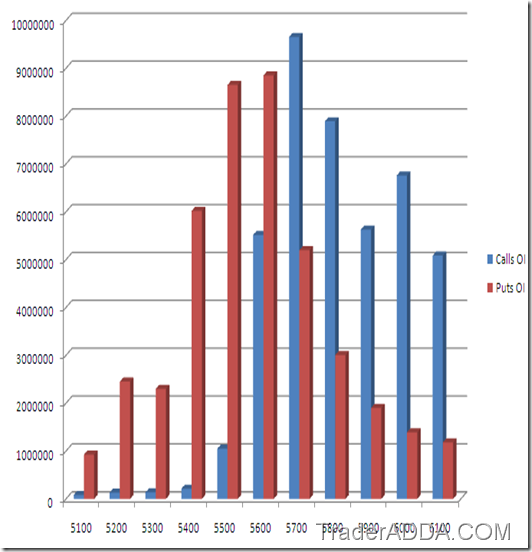

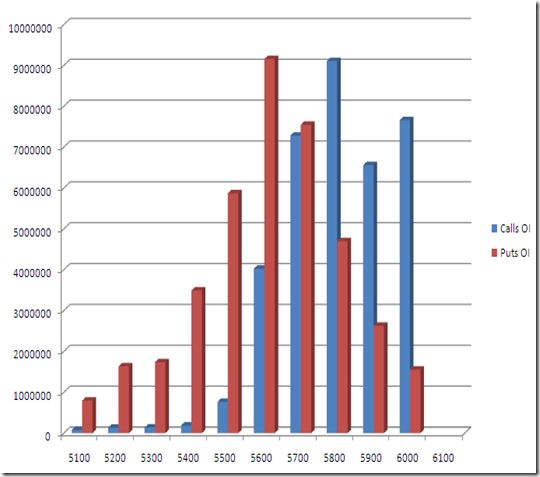

2. Open Interest Graph :-

Below Graph Shows Different Strike Price Calls and Puts Open Interest in Graphical Way.

3. Change In OI Graph:-

Below Graph Shows Change in Open Interest in Different Strike Prices in Graphical Way.

TraderAdda Few Cents:-

- 5700 CE OI is on fire with 23 Lakh addition and Total OI at above 1 Crore. 5600 PE OI is again highest OI in Puts with increase of 19 LAKH.

- It will be tough fight situation to hold 5600 for this expiry and further change in OI will show what next is coming.

Disclaimer and RISK WARNING:-

Any Trades and Calls and any analysis are Posted for Educational Purpose and nobody should take it as a Recommendation to Trade. If anybody is Trading these calls then He/She will be solely responsible for his/her Profit/Loss. Before taking any Trade please take advice of your Financial Advisor.

I may or may not have positions in the Calls/Trades Shared here.